Understanding the Differences in Federal Energy Subsidies

By Thomas J. Pyle, Institute for Energy Research

On January 27, 2021, President Joseph Biden stated:

“Unlike previous administrations, I don’t think the federal government should give handouts to big oil to the tune of

$40 billion in fossil fuel subsidies. And I’m going to be going to the Congress asking them to eliminate those subsidies.

We’re going to take money and invest it in clean energy jobs in America — millions of jobs in wind, solar, and carbon capture.”

President Biden followed his prepared remarks by issuing an executive order directing federal agencies to “eliminate fossil fuel subsidies as consistent with applicable law.” What’s not clear is which of these could be eliminated under his order, given the industry’s tax treatment is part of the tax code. President Biden also said he would ask Congress to end the $40 billion in fossil fuel subsidies through legislation. But where does that number even come from? Even the most ambitious estimates from anti-fossil groups can only manufacture a little more than a quarter of that number.

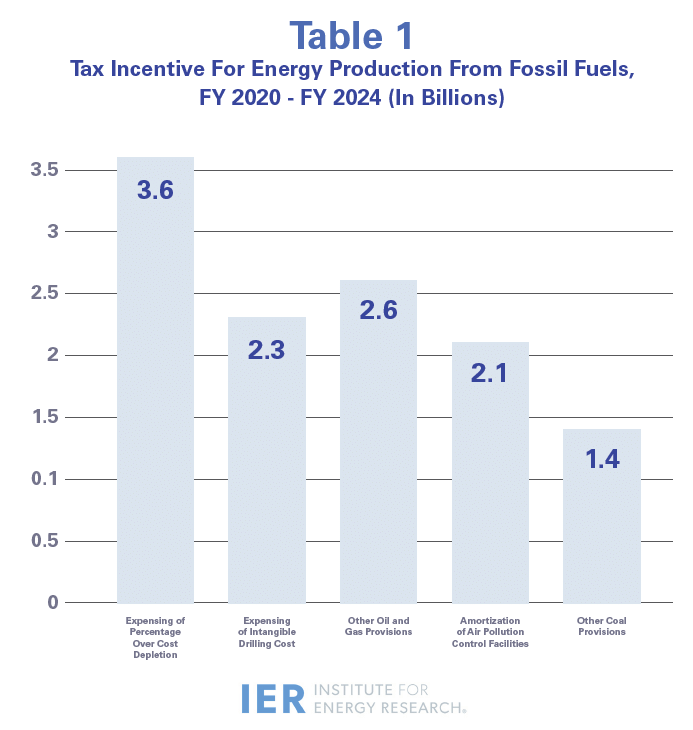

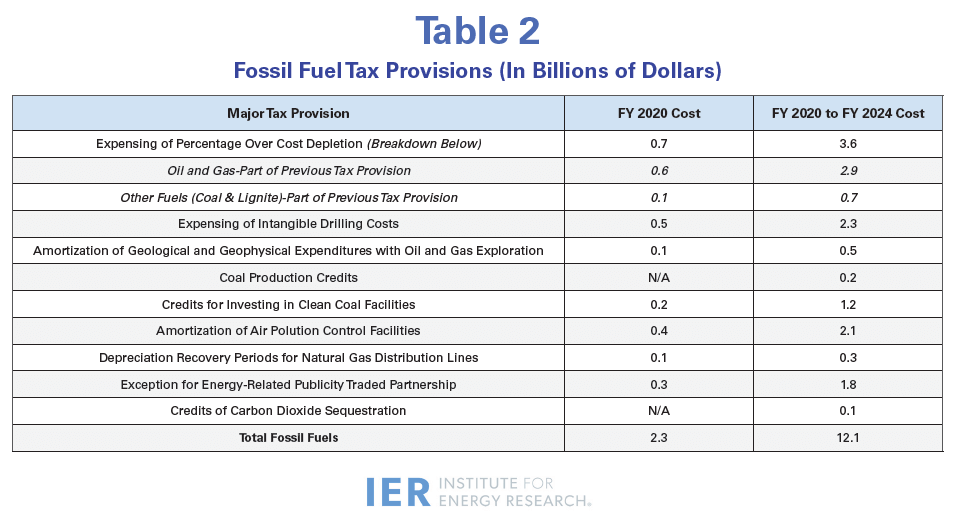

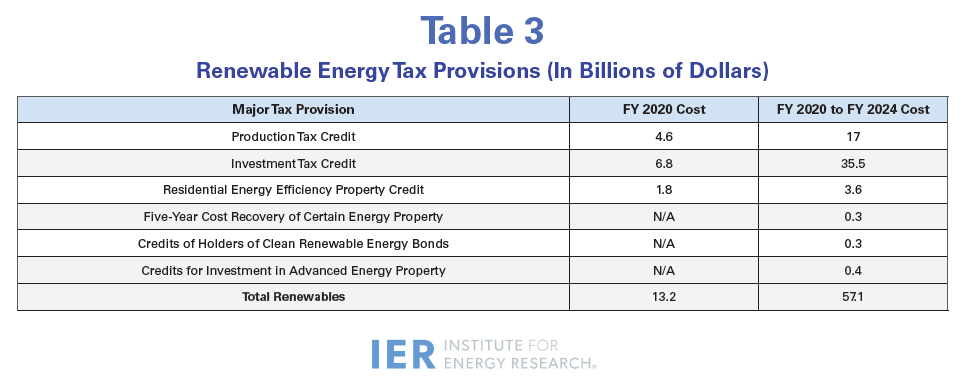

There are several inaccuracies in President Biden’s statements. First, the fossil fuel industry mainly receives tax deductions, not tax subsidies. Second, the tax deductions that the fossil fuel industry receives are estimated by the Joint Committee on Taxation to total $2.3 billion in fiscal year (FY) 2020 and $12.3 billion between FY 2020 and FY 2024. In comparison, the U.S. Treasury estimated that the wind Production Tax Credit (PTC) alone will cost taxpayers $40.12 billion between fiscal 2018 and fiscal 2027, making it the most expensive energy subsidy under current tax law. As the estimates herein show, the solar industry, which receives an investment tax credit, is likely to give wind competition for that highest subsidy honor. President Biden and his staff may have gotten renewable energy subsidies and fossil

Tax Deductions vs. Tax Credits – What’s the Difference?

Fossil fuel companies receive mainly tax deductions, not credits, while renewable energy receives incentives mainly in the form of tax credits. So, what’s the difference? Credits are much more valuable to companies because they represent a dollar-for-dollar reduction in any taxes owed as compared to deductions, which are based on the percentage of income tax owed. Since the corporate income tax is currently 21 percent, tax credits are worth about five times as much as deductions to a claimant.

A quick glimpse at the oil and gas industry might help. Many of the tax deductions attributed to the industry are mainly targeted to small independent producers. Two such deductions are the percentage depletion allowance and expensing of intangible drilling costs. As the oil and natural gas in a well are depleted, independent producers are allowed a percentage depletion allowance to be deducted from their taxes, similar to the depreciation of assets recognized across the tax code for all businesses. This allowance was first instituted in 1926 to compensate for the decreasing value of the resource, and was eliminated for major oil companies in 1975. The tax deduction is estimated to have saved the independent oil and gas producers about $0.6 billion in fiscal year 2020.

Small independent producers are also allowed to expense the full value of certain costs associated with the drilling and development of wells, known as intangible drilling costs, to encourage them to explore for new oil. The major companies can only claim a portion of this deduction. This tax treatment is also similar to that of most other businesses for such investments as research and development. This tax deduction is projected to have saved oil and gas producers about $0.4 billion in fiscal year 2020.

The Domestic Manufacturing tax deduction allows all industries and businesses to deduct a certain percentage of their profits. For oil and gas, it is 6 percent, for all other industries (software developers, corporate media, video game developers, the motion picture industry and green energy producers, among others), it is 9 percent.

Other tax provisions for fossil fuels include: publicly traded partnerships, which allow pass-through oil and gas partnerships to publicly list their shares; amortization of geological and geophysical expenditures associated with exploration; accelerated depreciation of natural gas infrastructure; and amortization of air pollution control facilities, which applies to coal power plants.

There are tax credits for investing in clean coal facilities and for producing certain coal – refined coal and Indian coal. The Indian coal tax credit is a per-ton production credit for coal reserves owned by an Indian tribe for up to an 11-year period. The refined coal tax credit is a per-ton production credit for refined coal used to produce steam, for the first 10 years of qualifying production. Refined coal has been subjected to a technology treatment to reduce certain emissions (e.g., sulfur dioxide, nitrogen oxide, mercury). The refined coal tax credit is set to expire in 2021.

In addition to other deductions both renewable and fossil energy companies might receive, eligible renewable facilities receive additional tax credits. The wind PTC was instituted as part of the Energy Policy Act of 1992 and intended to be short-lived to spur the deployment of a “young” industry. It has been extended 13 times. The solar investment tax credit provides a credit on the initial construction cost for a solar facility. Originally, the credit was 30 percent, but it has been phased down, and will remain at a 10 percent permanent credit for commercial facilities until Congress sunsets it.

Source: Joint Committee on Taxation

Estimated Costs and Future Projected Costs to Taxpayers

According to the Joint Committee on Taxation, the wind PTC is estimated to cost taxpayers $4.3 billion in fiscal year 2020, and the investment tax credit for solar is estimated to cost $6.7 billion. Table 3 shows slightly higher numbers for renewable tax incentives because other renewable fuels also receive those credits. By comparison, coal’s tax incentives in Table 2 for fiscal year 2020 are estimated at $0.7 billion. In 2020, renewable fuels received tax incentives of $13.2 billion compared to $2.3 billion for fossil fuels. Clearly, renewables receive much larger tax incentives than the fossil industry – by over a factor of five in FY 2020. Looking at the tax estimates for FY 2020 to FY 2024, total renewable fuel tax incentives are estimated at $57.1 billion, while those for fossil fuels are estimated at $12.1 billion, of which the share for coal is $4.2 billion. Clearly, the fossil fuel industry does not get $40 billion in tax incentives from the federal government, as President Biden has incorrectly stated.

Value of Incentives vs Energy Supplied

When compared to the amounts of energy produced by the differing sources, taxpayers are getting little benefit from wind and solar compared to the benefit from coal, oil and natural gas. Almost all of our transportation system is fueled by oil, natural gas is the largest energy source for home heating and until recently, coal generated 50 percent of U.S. electricity. In 2019, coal still provided 23 percent of U.S. electricity generation despite significant regulatory constraints and enormous taxpayer-funded tax credits and state mandates for competing sources like wind and solar.

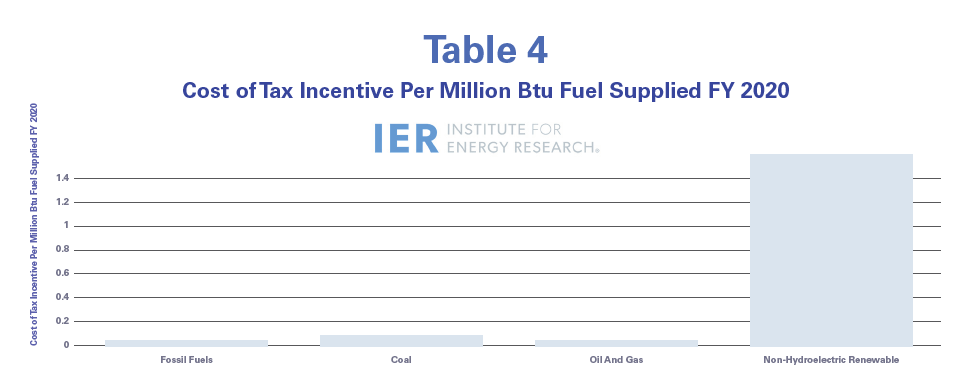

Source: Joint Committee on Taxation

The advantages and disadvantages of these incentives vary greatly in terms of benefits – revenues to the government, employment and energy contribution. Even if you accept the environmentalist argument about tax deductions, the tax benefits available to coal, oil and natural gas producers pale in comparison to the vast sums of money gifted by taxpayers to wind and solar generators. After all these billions, the U.S. economy only received 4.3 percent of its energy from wind and solar, compared to 79 percent from fossil fuels in fiscal year 2020. On a unit of fuel-supplied basis, the tax incentives for fossil energy supplied 48 times more energy than the tax incentives for non-hydroelectric renewable energy; the tax incentives for oil and gas supplied 60 times more energy than the tax incentives for non-hydroelectric renewables; and the tax incentives for coal supplied 20 times more energy than the tax incentives for non-hydroelectric renewables.

Source: Energy Information Administration and Joint Committee on Taxation

Conclusion

President Biden is either mistaken or he is misleading the public by saying fossil fuels receive federal tax subsidies of $40 billion – a number more in line with what wind and solar receive. Further, President Biden is conveniently leaving out the fact that fossil fuels supply 79 percent of our energy and that wind and solar power only supply 4.3 percent, even after years of direct federal subsidization in the form of tax credits.

Given that fossil fuels supply the majority of the nation’s energy needs but receive just one-fifth of the incentives that renewable fuels receive from the federal government, they represent a far better return to the taxpayer. Renewable subsidies are enormous compared to the amount of energy produced by the beneficiaries of these incentives. A better federal policy would be for the Biden administration to eliminate all subsidies for all forms of energy and let them compete on their own.

Thomas J. Pyle is the president of the Institute for Energy Research (IER).