Climate Dogmas and Energy Realpolitik

By Michelle Michot Foss, Rice University’s Baker Institute for Public Policy, Center for Energy Studies

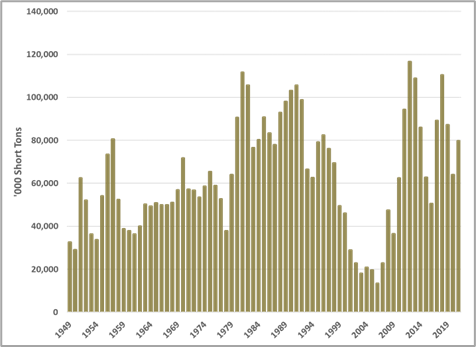

A funny thing happened on the way to the energy transition, current version (there will be many). Coal, much maligned, is back in vogue.

In this transition, coal-fired power plants are being challenged as never before. The traditional providers of baseload power have moved to flexible operations in response to market forces and the need to balance the variable output of solar and wind resources to meet modern society’s need for a reliable supply of economical electricity. Power plants originally designed for baseload operation with maximized efficiency were not designed to operate flexibly, and the change introduces significant challenges in plant management and maintenance.

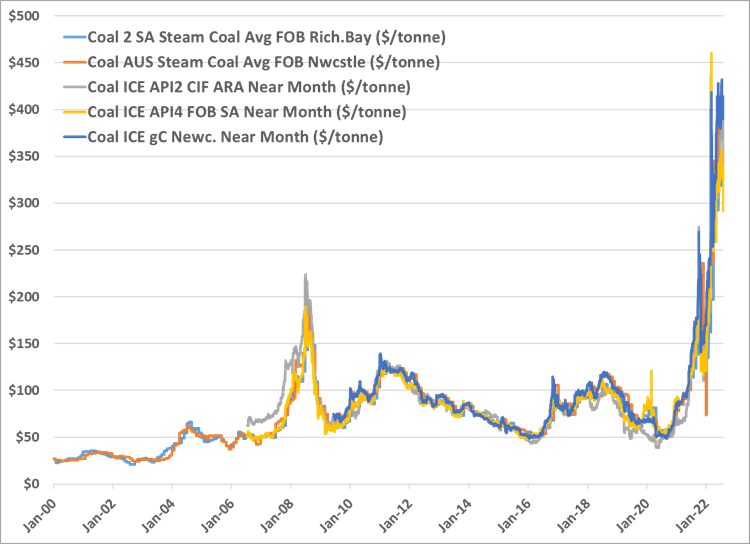

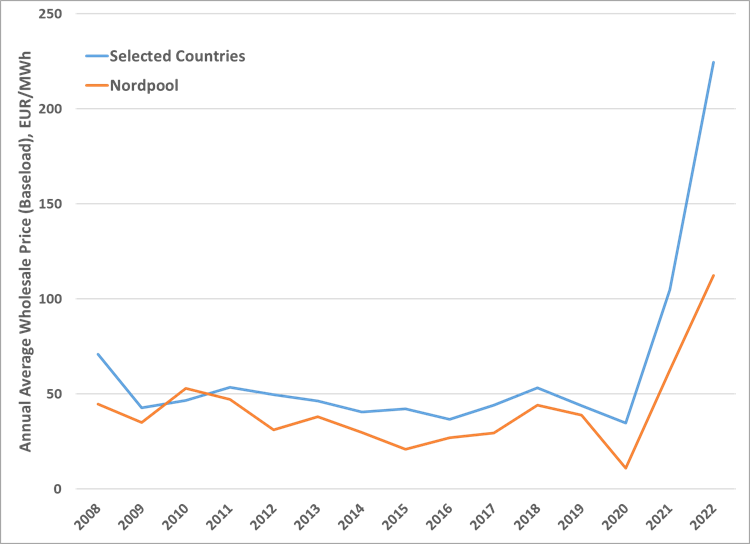

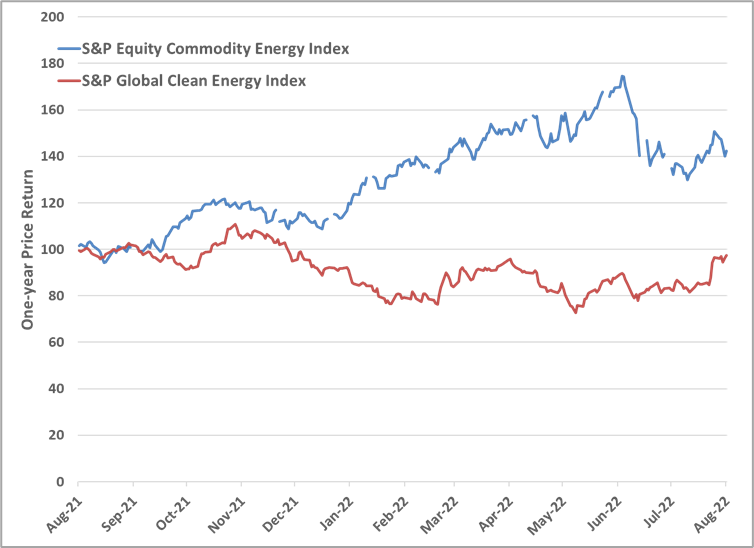

Post-pandemic, U.S. exports have climbed steadily – continuing a surge since the early 2000s. Coal prices have zoomed – in tandem with European power generation needs and wholesale pricing (see charts below). These dynamics are showing up equities values for global producers of fossil fuels – oil, natural gas and coal. Indeed, noticeably, inconveniently, the values of fossil fuels producer shares are considerably more attractive than those of clean energy tech companies. For that matter, clean energy tech has underperformed the broader market indices, even with inflation and recession fears triggering bumps to the S&P 500 and Dow Jones Industrials during 2022.

None of this was supposed to happen. What gives?

Recent pressures, in particular from war-impacted Europe and global ripple effects, on top of emergence from lockdowns, certainly have contributed to market responses the past few months.

A broad misreading of pandemic-suppressed energy demand was trumpeted as widely heralded permanent demand destruction for fossil fuels. The corollary was that alternative energy (alt energy) tech would accelerate as both a solution and investment play. Investors jumped into alt energy tech equities, spurred by collapsing fossil fuels prices and shares values. Government pronouncements of green new deals as pandemic recovery strategies, widely covered by news media, goosed alt energy tech investment. Yet, demand rebound, evidenced in motor fuels sales in the U.S. and elsewhere, put paid to the notions that petroleum fuels were passé. The problem now is that demand resurgence crashed headlong into reactions by petroleum producers and refiners to cut capacity. Mismatches between activism, policy-making and timing for alt energy tech rollout have triggered new concerns about disabling disruptions to economies and political ructions.

However, longer term signposts of trouble are there, should anyone care to look.

Coal Prices – Through the Roof

Germany long has been closely watched for its Energiewende transformation to dismantle nuclear (ramped up after the 2011 tsunami disabled Japan’s Fukushima nuclear facility) and decarbonize with wind and solar. Natural gas was the enabler – large volumes piped from Russia kept German factories humming and Germans warm during winter while industry built out the rest of the Energiewende infrastructure. Germany may well be the canary in the, pardon, coal mine.

Energy transition timing looks wonderful in spreadsheet decarbonization. Models project smooth trajectories as alt energy tech displaces legacy fuels and systems. Modelers incorporate low case scenarios but mainly present them as warnings if governments, voters, industry and investors do not act quickly enough. Miscalculations are rampant, largely centered on assumptions that we would challenge vigorously through any normal due diligence review. Yet these are not normal times. Climate emergencies and desires to use crises to justify energy transition acceleration command unquestioned acceptance of even the most outlandish timelines, costs and tradeoffs.

Powerful Incentives

One of the biggest miscalculations is the distinct tradeoff between energy density and performance that comes with alt energy tech. A close second is the specific connection between lower energy density and higher materials intensity. These topics are critically important yet often remain out of the media and public discourse. Even within the energy industry, these miscalculations may not receive the attention they merit.

What a Difference a (Pandemic) Recovery Makes

When it comes to performance, fossil fuels and nuclear pack a punch that is tough to replace. Each of the 55 nuclear plant locations in the U.S. provides more than 14 million megawatt hours (MWh) on average. In total, these facilities contribute 20 percent of the more than four billion MWh of electric power the U.S. consumes. Each of the 244 coal generation locations averages nearly 3.2 million MWh. Together, coal generators still comprise 19 percent of U.S. total power usage. Each one of the 1,800 natural gas generation locations averages 900,000 MWh. Combined, these plants contribute more than 40 percent of U.S. power needs. On any given day, that share might top 50 percent or more to balance wind and solar. And so, for comparison, some 1,422 wind locations with roughly 75,000 turbines in operation average around 240,000 MWh, a scant fraction of the typical coal or, much worse, nuclear plant. In total, existing wind facilities make up about 8 percent of U.S. electric power. The nearly 4,600 grid scale solar locations each average 19,000 MWh and about 2 percent of U.S. power production. Wind and solar locations encompass millions of acres already, with millions more needed for high voltage transmission fairways to carry energy to load centers distant from prime, grid scale wind and solar production.

The implications of exiting fossil fuels and nuclear are profound. It absolutely is true that coal, uranium, oil and natural gas must be extracted and processed and that their supply chains rest on extensive transportation logistics. This means land use and associated impacts that, altogether, approach the large land areas linked to wind and solar deployment. In exiting fossil fuels and nuclear we are giving up the energy content inherent in these resources, stored until we use it. If electrochemical storage is the preferred option to displace fossil fuels and uranium, we must extract and process all of the minerals, entailing their own extensive supply chains that are essential building blocks for batteries to store energy produced from wind and solar. Battery chemistries now and for the foreseeable future still pale when stacked up against energy-dense petroleum fuels and natural gas. When we add the shift from petroleum fuels to battery electric vehicles for mobility to the equation, the implication is a vast commitment of natural resource endowments to the energy transition project. In sum, we face a much larger call on raw materials than we do, and ever did, for legacy fuels and systems.

These last points are receiving more consideration, if not the physical and chemical underpinnings. That call has consequences for investment

in industries – mining and minerals processing – for which there is as much public antipathy as for extraction of coal, oil, gas and uranium. We already consume, at fast-growing rates, non-fuel minerals for everything from smartphones to health-care equipment and products. As with legacy fuels, pandemic recovery spurred demand in consumer and industrial goods that has pressured non-fuel commodities prices. Expectations of enormous growth in consumption for the gamut of alt energy tech is feeding a bull run in metals markets, contributing to inflation stresses.

Pre-pandemic, the justification for alt energy tech was that it was cheap – cheap wind and solar components and cheap batteries would make, and keep, alt energy more affordable. But more expensive inputs – minerals and metals, plastics and resins and the hydrocarbons used to make them (another key miscalculation is our continued need for hydrocarbon-based materials) and higher energy costs for extraction through manufacturing and distribution are eroding profit margins for wind, solar, batteries and electric vehicles (contributing to lower values for many alt energy tech shares). Materials supply cost curves also reflect extractives industries’ economics. We tend to pull from the best, most accessible, richest natural resource endowments first. Humans are just efficient that way. Over time, quality deteriorates and we must pursue less attractive opportunities, contingent upon technologies and enabling price signals. The latter are usually higher than customers would like to pay, setting up the classic producer-consumer sovereignty tradeoff. Across the non-fuel mining industry, lower ore grades with maturing properties, lack of exploration and drilling (previous long years of less attractive commodities prices), mean more processing, more effort, more waste to manage with more energy consumed and more emissions produced to achieve the tonnages needed for current consumption, much less to feed the energy transition project. As well, there are quality requirements that suppliers must meet to satisfy battery grade (semiconductors grade and so on).

We do a good job recycling and recovering and/or repurposing across many materials and minerals but not nearly at the levels needed for the huge expansion envisioned in alt energy tech. We do a poor job recovering materials from electronic waste, a fast-growing problem. The recycling industry faces its own set of challenges winning public and regulatory support for new facilities and expansions.

Another contributing factor to cheapness of alt energy components is China’s role as manufacturer to the world. The enormous slugs of capacity for wind (estimates of 60 percent of global), solar (roughly 70 percent), large format batteries for electric vehicles (70-80 percent or even higher, depending upon chemistry) have made Chinese suppliers the ones to beat. Along with that capacity comes Chinese dominance in materials supply chains. China’s own domestic production of key metals and other minerals for defense, non-defense, energy and non-energy needs is 18 percent of world, while the U.S. stands at about four, all of the European Union at about five and Russia at about five (but with high target products – titanium, platinum, high-grade nickel). China’s new sovereign monopoly created to corral the country’s rare earths businesses will be a particular constraint. As the largest single iron ore customer, China’s effort to exert purchasing power will resonate loudly. Geopolitical realities do not simply revolve around China’s home businesses. They also emanate from China’s massive outbound investment, the Belt and Road gauntlet that deserves a much harder look as other nations jockey for positions to source vital materials.

In sum, we are far from understanding the full burden of costs, risks – including both hard and soft security – and any number of other ramifications associated with notions about how, and over what timeframe, any version of energy transition and transformation can occur. Nor do we yet have appreciation for the full burdens of sustainability, in all dimensions. An ironic possibility is that fossil fuels, including even coal, may do far more to secure our energy, economic and environmental futures than we are willing to admit.

Michelle Michot Foss, Ph.D., is a Fellow in Energy, Minerals & Materials at Rice University’s Baker Institute for Public Policy, Center for Energy Studies