How U.S. Natural Gas Dynamics Are Intensifying the Effects of Coal Retirement

By Eugene Kim, Elyse Steiner, Dulles Wang and Adam Woods, Wood Mackenzie

The story for thermal coal in 2022 can be summarized as one of tight markets with demand exceeding supply. Coal producers have been largely unwilling or unable to increase deliveries amid labor shortages, deficient rail services and limited access to capital markets. Even ignoring those factors, producers are resisting the temptation to chase the market for a few incremental tons, knowing that the current cycle is fleeting and they risk having an oversupply later. Meanwhile, utilities are under pressure to retire uneconomic coal capacity and reduce emissions yet still meet reliability and resiliency demands. In fact, the U.S. retired an average of 11 gigawatts of coal-fired generation capacity every year between 2015 and 2020, primarily because of market conditions.

We are reaching a tipping point where coal’s contribution to the generation mix and its ability to meet load at critical times could be at risk, especially if plants don’t have the fuel to react. Utilities are faced with the challenge of managing depleted stockpiles amid inadequate coal deliveries and rising power demand, especially during peak times. While the coal shortages are stressing the power system, the natural gas market is dealing with somewhat similar imbalances, price spikes and inflexibility created in part by the loss of coal-fired power generation capacity.

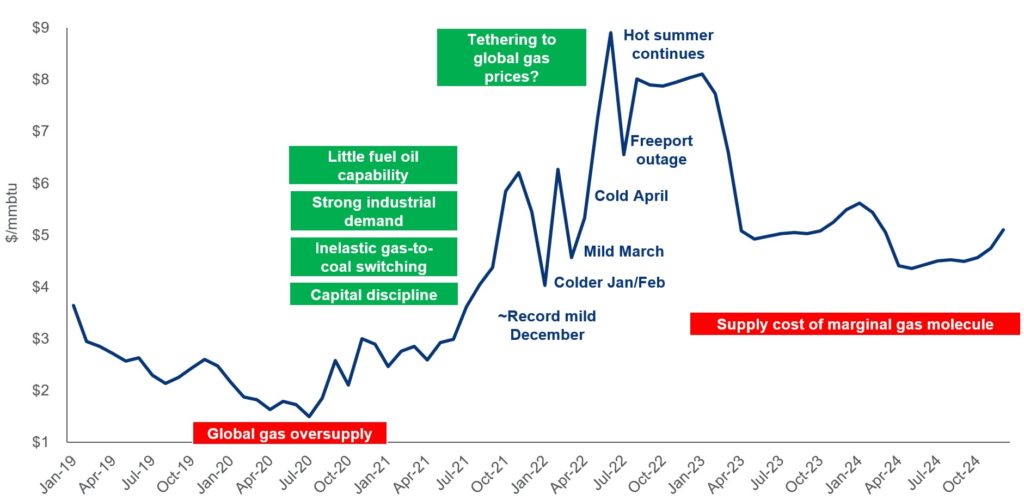

Volatility is the key word in today’s North American gas markets. Prior to the explosion and extended outage declared at the Freeport LNG facility in June, Henry Hub gas prices were threatening to enter double-digit territory, their highest level since 2008. The recent spikes in natural gas prices immediately followed a period of abundant cheap gas and weak demand.

It’s easy to forget that just two years ago, Henry Hub gas prices tumbled to a low around US$1.50/mmbtu with the pandemic depressing global demand. At that time, U.S. LNG feedgas requirements dropped from over 9 bcfd to less than 3 bcfd as U.S. LNG cargoes were being canceled. Today, there is more demand for gas than supply, more capital-disciplined producers, below-average storage volumes and reduced ability for utilities to switch to cheaper generating resources.

In this analysis, we explore the state of the natural gas market and how coal plant retirement could impact an already volatile gas market, especially during peak demand seasons and more frequent extreme weather events.

Where’s the Ceiling?

As the global economy started to recover from the economic downturn caused by the pandemic, the appetite for U.S. LNG rose. Then, after Russia’s invasion of Ukraine, LNG feedgas demand ramped up to more than 13 bcfd. U.S. gas production was unable to keep pace with the added LNG growth as producers exercised capital discipline and supply restraint. Add in sudden cost inflation, supply chain issues, labor shortages, ESG pressures and the lack of new northeast pipeline takeaway capacity, and production growth during 2021 and into 2022 slowed down considerably. The tight market in 2022 has exacerbated the price volatility, especially when temperatures rose between May and July in much of the country and pushed demand even higher, as shown in Chart 1.

Chart 1: Henry Hub Gas Price in the Short Term Goes Off the Rails as it Searches for a New Ceiling

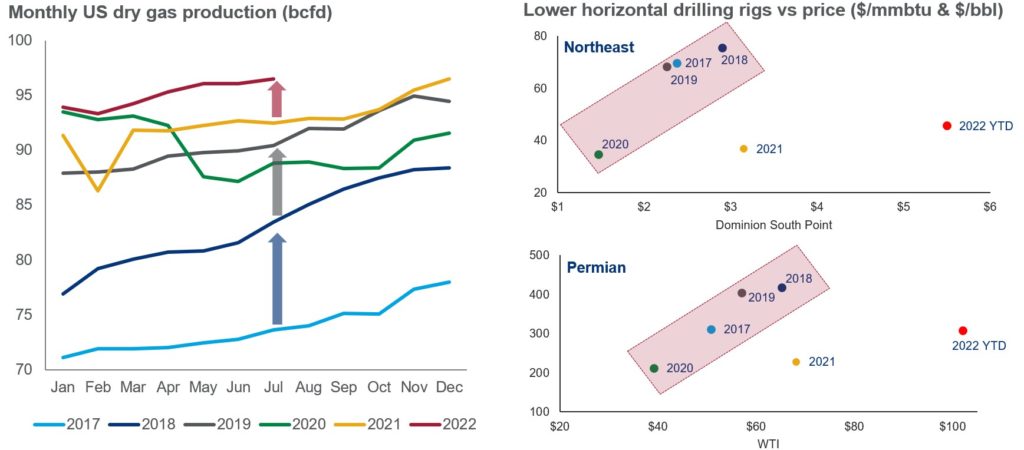

In previous years, U.S. dry gas production could be relied upon to keep growing at a steady clip. Prior to 2020, production rose nearly every month in response to increasing demand, even at significantly lower prices. Between 2017 and 2019, production cumulatively grew more than 17 bcfd.

However, behavior changed from before the pandemic and production growth slowed down considerably. Compared to prior years of strong production response to higher oil and gas prices, activity levels were more muted. As of July 2022, the year-on-year change for the same period is just 3.7 bcfd – not enough to keep pace with demand as shown in Chart 2a, (left-hand side below).

Even at prices that would have attracted more activity in the past, the rig count and production have been disappointing. In 2018, with regional gas prices under US$3/mmbtu, the northeast numbered over 70 horizontal rigs. Three years later, prices were slightly higher but horizontal rig count was near half of what it had been (Chart 2b). This year, as prices have escalated significantly from pre-pandemic levels and oil topped US$100 per barrel, horizontal rig counts are stuck not too far off their 2020 low.

Chart 2: U.S. Gas Production Response to Higher Prices More Muted

Than in the Past

Gas-to-Coal Switching Stalled

We are not running out of low-cost North American gas resources. In a balanced gas market, the cost of the marginal gas supply that can be brought into the marketplace is around US$3-4/mmbtu. The marginal gas molecule that is produced could be increased by higher hurdle rate requirements with lower reinvestment under a regime of capital discipline, increased regulatory and environmental compliance costs and inflationary pressures.

However, that cost to incentivize production longer term is not US$5 or 6/mmbtu and it is definitely not the double digits that the current NYMEX forward curves have threatened to breach.

The lack of demand response in the gas market also contributed to the recent gas price spikes. Economic gas-to-coal displacement has historically provided a powerful balancing mechanism during the summer injection seasons for North American gas markets. Higher gas prices would normally result in utilities switching generation from gas to coal units. However, as Henry Hub prices rallied higher in summer 2021, the economic displacement stalled with fewer coal units dispatching and demand response disappeared in the gas market (Chart 3).

The primary culprit was the lack of thermal coal production response, leading to severely depleted thermal coal stockpiles. Notably, the tightness in the coal market has not improved materially since 2021, resulting in elevated gas demand from the power sector which pushed gas prices to new highs, as shown in Chart 3.

Chart 3: Price Elasticity of Gas Power Burns Disappears at Higher Prices

Changes in Store for Seasonal Dispatch

Are we seeing a glimpse of what may be in store for the gas market with continued coal plant retirements? Absolutely.

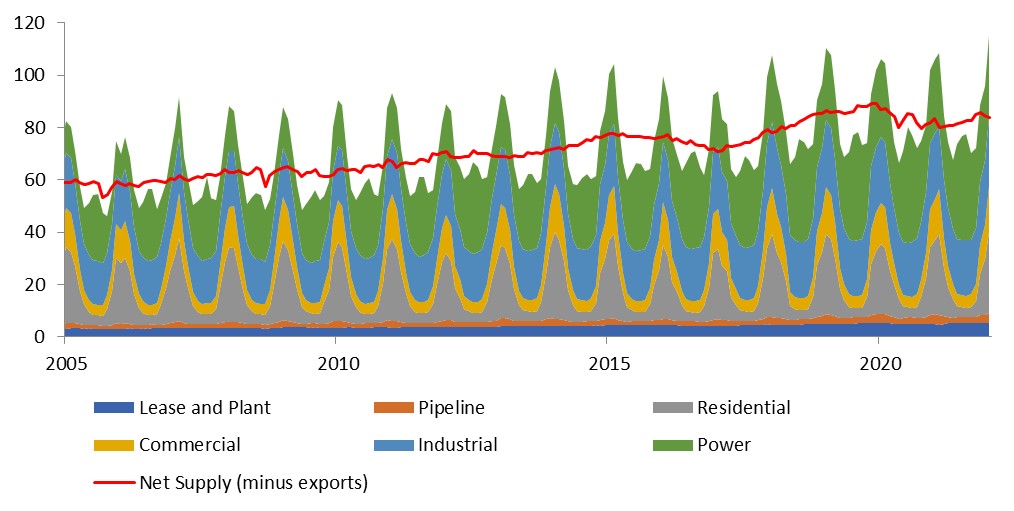

Coal and gas-fired plants are arguably the only power generation resources that can respond quickly and reliably to seasonal changes in power demand or even in extreme weather events. The U.S. gas market is winter peaking in nature as heating demand could be as much as 150 percent of the summer demand level. Any incremental demand increase could add a substantial burden to the gas market infrastructure where pipeline flows and storage withdrawals are highest, as shown in Chart 4 below.

Gas accounts for over 30 percent of the generation stack and is still rising in the near term. In comparison, coal-fired generation is 22 percent of total generation and expected to lose ground over time. With continued coal plant retirements, gas demand could see structural strengthening on a year-round basis.

In the summer months, elevated gas demand would compete with storage injection for gas use in the winter. In the winter months, the lack of demand response could have a profound implication on prices to ensure that there is enough supply to satisfy domestic demand. This could mean spiked regional prices to attract LNG imports in the northeast or even discourage LNG exports in the Gulf Coast in extreme cases. Without the traditional demand response in the power market in the form of coal-and-gas competition to help moderate gas demand, we would expect elevated seasonal price volatility in the gas market especially at times when LNG exports are also typically the highest.

As the U.S. power market continues to transform with the increased penetration of renewable generation, the burden on the gas market to support power demand throughout the year could be compounded by continued coal retirements. Before energy storage can be more widely deployed to firm up renewable generation, the gas market may require significant infrastructure investment to support structural changes in the power sector. Just how much the nation’s gas resources are tested will depend, in part, on the pace of coal plant retirements.

The authors are all with Wood Mackenzie. Elyse Steiner is principal analyst, North America Coal Markets; Eugene Kim is research director, Americas Gas Research Team; Dulles Wang is a director, Americas Gas and LNG Research team; Adam Woods is a research analyst.