Opportunity Knocks for US Exports: Sales Soar Abroad While Domestic Market Remains Flat

By Natalie Biggs, Luke Fritz, Adam Woods and Elyse Steiner, Wood Mackenzie

Historically considered a swing supplier on the seaborne market, U.S. coal is seeing a rise in global interest, and producers are keen to answer the call. On the thermal side, worldwide demand for coal to generate more electricity is on the rise at a time when the domestic market is reducing. Producers of high calorific value (CV) coal are pursuing opportunities to shift uncontracted coal into the seaborne market.

Metallurgical coal producers have been expanding mine capacity to increase sales abroad, while domestic demand remains flat. These capacity increases, from both brownfield and greenfield extensions, are well-timed to deliver as BF-BOF steelmaking in India and Southeast Asia increases.

In this article, Wood Mackenzie analysts share their view on near-term prospects for coal producers.

Domestic Demand Tapping the Brakes

Thermal

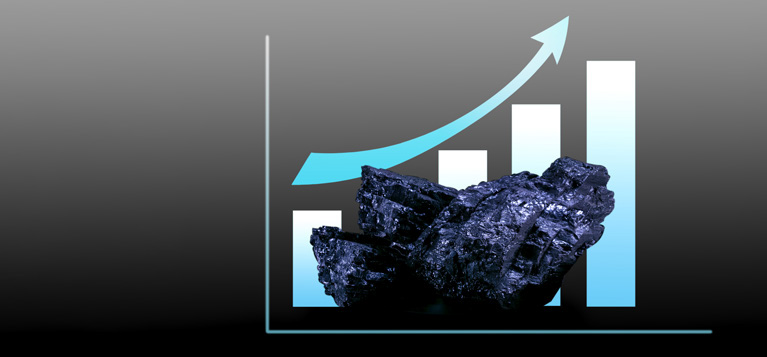

After a turbulent year fueled by high energy prices, supply chain and labor shortages, inadequate rail service and depleted inventories, the domestic coal market appears to be taking a breather. Producers spent much of last year playing catch-up with demand by hiring more workers and adding shifts to keep up with contracted deliveries. Tight domestic supply left scant incremental coal available in the spot domestic or export market, even at historically high prices. Already constrained coal supply across the globe was exacerbated by Russia’s invasion of Ukraine and subsequent sanctions.

Then 2023 arrived. Producers worked hard in the preceding months to increase output and were poised to rebuild domestic stocks. However, the new year kicked off with warmer than average weather across much of the country and a natural gas production boom – both of which hammered EGU coal demand. Gas prices plummeted by over 60 percent between September 2022 and February 2023, quickly handing the competitive advantage back to gas generation. Gas storage and coal stockpiles have been recovering quickly and potentially risk oversupply in the second half of the year. With inflation driving up production costs and eroding profit margins, producers will be searching near and far for the most promising outlets to sell any uncommitted tons.

Producers watching domestic U.S. thermal coal demand easing, prices weakening and costs escalating have limited options in the short term. After an extended period of depleted stockpiles, utilities finally have an opportunity now to rebuild inventories to more comfortable levels. With abundant coal on hand, they have more operational flexibility to shift generation as needed. However, EGU stockpiles may eventually reach their limit and be unable to accommodate additional deliveries.

The coal sector is also confronted with shrinking domestic coal-fired generating capacity as more plants face retirement. We currently expect over 30 GW of coal retirements in the next three years, which accounts for more than 40 Mstpa of coal demand. Unless miners cut production, they will have to look beyond our borders for buyers in Europe, India and other parts of Asia. For many producers with access to the export market, they are likely to find eager buyers abroad and record reasonable returns.

Metallurgical

We expect domestic demand for metallurgical coal to remain flat to 2022 levels in 2023. Increasing demand for steel from the Infrastructure Investment and Jobs Act and the Inflation Reduction Act will trickle down to increased demand for coke. However, the prospect of coke exports in 2023 is not as great as 2022, due to lower expectations in steel markets such as Europe and Brazil. Therefore, the increase from the government spending bills and the decrease from coke export demand will counteract each other.

Export Demand Helped by Global Disruptions

Thermal

While domestic demand may be softening for U.S. coal, global seaborne imports will be increasing in 2023, primarily driven by China and the end of its COVID restrictions. As domestic contracts roll off, producers could find more opportunities in the export market. Demand for high-CV coal should remain strong with bans on Russian coal in the EU, U.K., Japan, South Korea and Taiwan. Supply disruptions at other coal exporting countries, similar to those seen over the last year, could also open additional opportunities for U.S. coal. Globally, seaborne coal imports will grow from nearly 950 Mt in 2022 to 1,000 Mt in 2023 and 2024.

U.S. bituminous thermal coals are at a distinct advantage in the current market, especially with the bans on Russian coal. Before the war in Ukraine, Europe was heavily dependent on Russia – contributing 71 percent of total 2021 coal imports. Alternatives are limited on the seaborne market, where Russian exports represented over a quarter of the high-CV supply. Now European buyers are entering into term contracts with U.S. suppliers, many at fixed prices. Last year, 63 percent of European imports from the U.S. came from Appalachia while 37 percent originated in the Illinois Basin.

High-CV export competitors to the U.S. are limited in their ability to increase supplies. On top of that, in 2022, the La Nina wet weather pattern caused multiple supply disruptions across Australia, Colombia and South Africa, shorting high-CV supply even further last year. There are also structural issues that will limit U.S. competitors from increasing production in the short term:

- Colombia: The new government is looking to prevent any new mines from opening in the country (making the reopening of the 15 Mtpa Prodeco operation unlikely).

- South Africa: Struggles with rail transportation and domestic demand may limit export availability.

- Australia: Has some new projects but new operations there face government and financial hurdles.

U.S. coal producers seem to be in the best position to than expected from stronger global coal power needs (e.g., stronger economic performance, weather or gas shortfalls) or if export competitors continue to experience supply disruptions, the U.S. coal market has the most flexibility to fill in any gaps.

Metallurgical

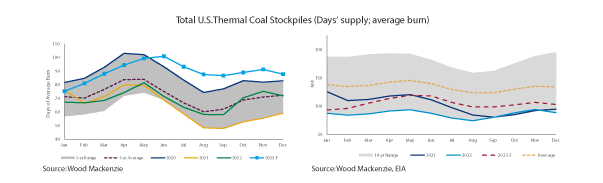

In 2023, U.S. seaborne exports will increase to 47 Mst compared to 44 Mst in 2022. Contributing to our outlook is the increase in supply availability and new pockets of demand. The U.S. met coal industry is increasing its capacity from new and existing operations, with the focus on the export market.

New pockets of demand will emerge in Europe, Japan, India and Indonesia in 2023, which marks the first full year of sanctions against Russian coal into Europe. End users stocked up on Russian PCI and coking coal prior to the full ban in August 2022. U.S. producers, especially high-volatile coal producers, will benefit in replacing Russian coals into Europe this year. Japan also sanctioned Russian coal as of April 1. Similar to Europe, the U.S. will benefit by sending its high-volatile coals as a replacement.

Important to U.S. suppliers’ long-term strategies, we expect exports to India and Indonesia to grow this year as well. Demand for metallurgical coal in both countries is growing consistently, as they rely on the traditional BF-BOF steelmaking route to develop their nations.

Investments to Increase Capacity Start Bearing Fruit Thermal

During the halcyon days of 2021-22, mining companies added labor and ramped up production that they will not want to immediately scale back. Exporting producers have added production capacity very recently and will be directing some of the incremental volumes overseas.

Alliance Resource Partners has projects at Tunnel Ridge and River View complexes to access additional reserves. For this year, at least half of the company’s uncommitted coal will likely be exported, and that percentage could rise depending on the market in the second half of the year.

CONSOL also increased production guidance for the PA Mining Complex, where a fifth longwall went into operation. They already have 8.2 Mst under contract for export at

fixed prices and expect to take advantage of additional opportunities in the European market later this year.

In the western U.S., Arch will be looking to ship up to 500,000 incremental short tons from West Elk to buyers in Asia. U.S. producers are betting that global markets maintain their appetite for U.S. high-CV coal, even as the domestic market cools off.

Metallurgical

Notably in 2023, we will see ramp-ups from mines such as Peabody’s Shoal Creek and Arch’s Leer South, as well as new production coming from CONSOL’s Itmann and AMCI’s Allegheny (Longview). Most of this new production has a focus on the export market. CONSOL’s Itmann mine is a low-volatile hard coking coal, while the other three mines are high-volatile A coking coals. Existing capacity plus the aforementioned capacity will put U.S. met coal production at the highest rate since 2014.

In short, export markets will provide support for U.S. producers. For now, U.S. producers will find buyers in the seaborne markets and shore up their margins. The opportunity to increase exports will provide some relief as domestic demand dwindles and stockpiles approach their limits.

The authors are all with Wood Mackenzie. Natalie Biggs is global head of thermal coal markets, metals & mining; Elyse Steiner is principal analyst, North America thermal coal; Luke Fritz is a senior research analyst and Adam Woods is a research analyst.